http://ecowatch.com/2014/03/20/udated-fracking-vs-american-dream-resource-guide/

Resource Media | March 20, 2014 4:01 pm

Last fall, Resource Media compiled an in-depth media tip sheet to provide journalists with background information and sources about the growing body of evidence linking drilling with widespread impacts on property values, property rights and quality of life in communities across America.

Since we first published Drilling vs. The American Dream, fracking has continued unabated, inching up and into ever more cities, towns and neighborhoods. To keep up with the changes, we updated the guide to include new data and research and new stories from the growing choir of millions of Americans who are now directly affected by oil and gas development:

Drilling vs the American Dream: Fracking impacts on property rights and home values

There are currently more than 1.1 million active oil and gas wells in the U.S., and more than 15 million Americans now live within a mile of the hundreds of thousands that have been drilled since 2000, according to an analysis by the Wall Street Journal. Made possible by the advent of fracking, drilling is taking place in shale formations from California to New York and from Wyoming to Texas.

And there’s no indication that this “unprecedented industrialization” shows any signs of slowing. Almost 47,000 new oil and natural gas wells were drilled in 2012, and industry analysts project that pace will only continue.

Drilling rigs now regularly inch up and even into communities that never anticipated having to address problems like round-the-clock noise, storage tanks, drums of toxic chemicals, noxious fumes, near-constant truck traffic and pipelines near homes, schools, playgrounds and parks. For many, the impacts of this kind of large-scale industrial activity are incompatible with quality of life.

Congressman Jared Polis saw this firsthand last fall when a drilling rig went up on property neighboring his small farm in Weld County, CO. Polis, who said he had no notice of the fracking operations, filed a complaint with state regulators and then a lawsuit over concerns “about the impact that fracking has on the health of communities as well as the economic impact as it relates to property value.”

Also look no further than Exxon CEO and board chairman Rex Tillerson, who is suing to stop construction of a water tower that would supply nearby drilling operations because of the nuisance of, among other things, heavy truck traffic, noise and traffic hazards from the fracking operations the tower would support. That’s right, the head of the single largest drilling company in the world, acknowledges the “constant and unbearable nuisance” that would come from having “lights on at all hours of the night … traffic at unreasonable hours … noise from mechanical and electrical equipment.” Tellingly, Tillerson’s lawsuit—filed in 2012 with other plaintiffs, including former House Majority Leader Dick Armey—claims the project would do “irreparable harm” to his property values.

At a more macro level, research is staring to show that energy booms such as the current drilling frenzy may not be the economic windfall that boosters make them out to be. After the initial surge in income and jobs that comes with drilling, problems inevitably follow: higher crime rate, decreased educational attainment and over the long run, significant declines in income. The more heavily a community ties itself to the drilling economy, the greater the decline.

“The magnitude of this relationship is substantial,” the study authors are quoted saying in the Washington Post, “decreasing per capita income by as much as $7,000 for a county with high participation in the boom.”

For those who own the rights to the oil and gas on their properties, the impacts of drilling can be offset by royalty payments that come from selling them to oil and gas developers. But in most parts of the country, the legal doctrine of split estates allows one party to own the rights to minerals and other resources below the surface while someone else hold the rights to property above ground. With the oil and gas industry showing little self-restraint and drilling encroaching into cities, towns and suburbs, split estates have left millions to deal with problems such as increased truck traffic, chemicals, lights, noise, heavy equipment, noxious air emissions and water—all without any compensation.

There are weak regulatory protections and few legal precedents to protect residents from this kind of industrial activity in their back yards. Regulations on how far drilling must be set back from homes and schools, for example, provide almost no cushion—often only several hundred feet—to mitigate drilling’s impacts on nearby homes and businesses.

Feeling unprotected by weak state and federal regulations, however, more and more communities are starting to fight back by passing local laws restricting or banning fracking within their borders. Pittsburgh became the first to take matters into its own hands with an ordinance in 2010. Since then, many others have followed suit: Dallas, Los Angeles, multiple cities and towns in New York, New Jersey and Pennsylvania, counties in New Mexico. Last fall in Colorado, voters in four cities passed ballot measures banning or severely restricting fracking, three of them overwhelmingly. And this year, backers are gathering signatures for a 2014 statewide ballot measure that would give Colorado cities and towns local control over drilling-related policy decisions within their borders.

This pushback against drilling and its impacts goes beyond simple NIMBYism. The financial risks posed by drilling are real and substantial enough—as detailed below—that banks and insurers are also now adopting guidelines that forbid mortgage loans or insurance coverage on properties affected by drilling. It’s a battle between oil and gas and the nest egg of countless Americans.

The following examples begin to piece together the ways in which the threats posed by drilling and the deep pockets of the oil and gas industry quite literally hit home. Taken together, they are a call for decision-makers to start quantifying data and asking tough questions about drilling vs. the American Dream.

- In a 2013 survey of 550 people conducted by business researchers at the University of Denver, a strong majority said they would decline to buy a home near drilling site. The study, published in the Journal of Real Estate Literature, also showed that people bidding on homes near fracking locations reduced their offers by up to 25 percent.

- Realtors in Colorado are taking note as clients become increasingly hesitant about buying homes near drilling sites, with fewer and fewer bids rolling in. “Some don’t want to even look at anything remotely close to any existing or proposed well sites,” Boulder County real estate agent Nanner Fisher told the Colorado Independent. She also told Boulder iJournal that “if there is a well that’s visible when you show a property, [the prospective buyer] will ask to look for something else. A lot of it is the visual effect of the well site,” she said. “And, they think if you can see it, it’s gotta be close enough that it’s not healthy.”

- An economic analysis by the Headwaters Institute undermines the idea that oil and gas developments fatten the bank accounts of communities and leave them better off than before drilling started. While there may be short-term windfalls, the study of six western states found that over the long-term “oil and gas specialization is observed to have negative effects on change in per capita income, crime rate and education rate.”

- Denver Realtor Adam Cox wrote in a column in the Colorado Statesman that “potential buyers balk at buying homes near a drilling site, even though that’s often where the discounted homes are” because they are so close to oil and gas activity. Similarly, he said, homeowners near drilling sites “often have to sell at significantly lower prices than when originally purchased due to the oil and gas industry neighbors.”

- The fumes, lights and deafening noise that came after a neighbor leased adjacent land for fracking became unbearable and forced to move from their Cleveland suburban home. In an interview with Reuters, she said they were able to sell their house for $225,000, only half its appraised value.

- In the Catskills, fracking fears have already impacted the real estate market even though the state has yet to make a determination on whether to allow drilling. The prospect that the state will open the region to drilling, as the New York Times reported, “has spooked potential buyers” in upstate New York. The Times story also quoted a realtor who shut down her business In Wayne County, PA. Agents there, the woman said, are having trouble selling rural properties “because people don’t want to be anywhere near the drilling.”

- A study conducted by researchers at Duke University found that the risks and potential liabilities of drilling outweigh economic benefits like lease payments and potential economic development in Washington County, PA. Even though lease payments can add overall value to homes with wells drilled on them, the possibility of contaminated water decreases property value by an average of 24 percent. The boost that comes from signing a lease offsets the increases, leaving a net decrease in value of 13 percent.

- A 2010 study of the Texas real estate market in the heavily drilled suburban-Dallas area near Flower Mound concluded that homes valued at more than $250,000 and within 1,000 feet of a drilling pad or well site saw values decrease by 3 to 14 percent.

- Faced with a boom in coal-bed methane development in the early 2000s, officials in La Plata County, CO studied the impacts of oil and gas development and found that properties with a well drilled on them saw their value decrease by 22 percent.

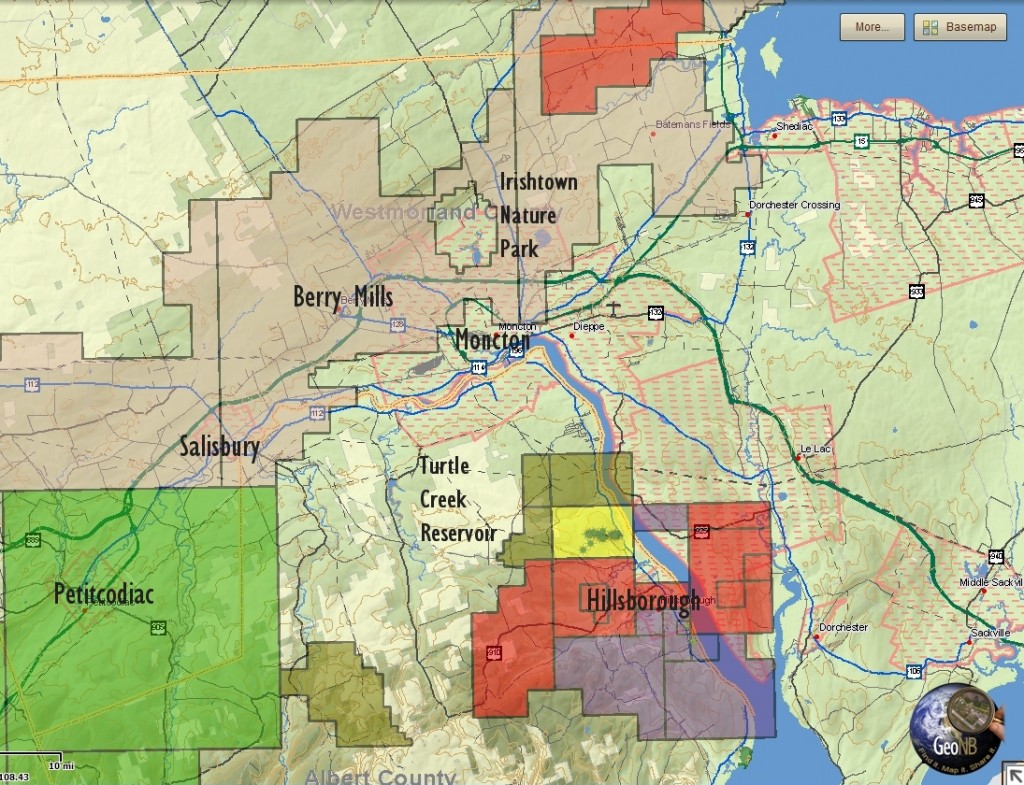

- In a 2005 peer-reviewed study, researchers found that oil and gas production “significantly affect the sale price for rural properties.” The study determined that the presence of oil and gas facilities within 2.5 miles of rural residential properties in Alberta, Canada reduced property values between 4 percent and 8 percent, with the potential for doubling the decrease, depending on the level of industrial activity.

- In Pavilion, WY, where the EPA has linked groundwater contamination with fracking, Louis Meeks saw the value of his 40-acre alfalfa farm all but disappear completely. In 2006, his land and home were appraised at $239,000. Two years later, as ProPublica reported, “a local realtor sent Meeks a coldly worded letter saying his place was essentially worthless and she could not list his property. ‘Since the problem was well documented … and since no generally-accepted reason for the blowout has been agreed upon,’ she wrote, ‘buyers may feel reluctant to purchase a property with this stigma.’ ”

- Similar nightmares have befallen residents of Dimock, PA, where fracking problems decimated home values, and the drilling company responsible, Cabot Resources, was ordered to pay impacted families settlements worth twice their property values, a total of more than $4 million.

- In North Texas, the Wise County Central Appraisal District Appraisal Review Board knocked down the appraised value of one family’s home and 10-acre ranchette from $257,000 to $75,000—a decrease of more than 70 percent. The board agreed to the extraordinary reduction as a result of numerous environmental problems related to fracking—just one year after the first drilling rig when up on the property.

A well and battery of natural gas storage tanks near homes in Longmont, CO. Photo credit: Our Health, Our Future, Our Longmont

Property Rights

- Unbeknownst to many suburban homeowners, homebuilders are starting to quietly retain mineral rights beneath the subdivisions they build in suburban areas. DR Horton has been perhaps the most notable construction company to employ this new tactic. In 2012, after an investigation by the North Carolina Attorney General’s Office and the state’s Real Estate Commission, officials pressured the Texas-based homebuilder to return mineral rights it had retained from beneath about 850 homes. Residents who live in a Florida subdivision built by Horton were equally surprised when they found out that the company also held the rights to prospect for whatever minerals lie beneath 2,500 of their homes near Tampa.

- As documented by Reuters, homeowners in subdivisions in Colorado, Florida, North Carolina, Louisiana and other states have all purchased homes without disclosure about severed mineral rights only to see drilling rigs spring up next door too late for them to do anything about it. “This is a huge case of buyer beware,” University of Colorado-Denver Law Professor Lloyd Burton told reporters. “People who move into suburban areas are really clueless about this, and the states don’t exactly go out of their way to let people know.”

- Senate and House committees in the Colorado Legislature have passed a measure that, much like disclosures for lead paint, would require sellers to notify prospective homebuyers about separated mineral rights and whether a property may be subject to oil, gas or mineral development. Senate Bill 14-009 is awaiting approval by both chambers to be forwarded to the governor.

- In at least 39 states, there are laws that compel “holdout landowners” to join gas-leasing agreements with their neighbors, allowing oil and gas companies to drill horizontally to tap into oil and gas reserves that cross property lines—whether the owner of a property wants to allow the drilling or not. Called “mandatory pooling” or “compulsory integration,” these laws basically create eminent domain by private enterprise.

- Pooling gives the owner an interest in the well, including royalty payments, but as in Colorado, where forced pooling orders were issued by the state’s Oil and Gas Conservation Commission 48 times in 2010, the law also makes the unwilling owner “liable for the further costs of the operation, as if he had participated in the initial drilling operation.”

The intent of forced pooling is to create more orderliness in drilling underground oil and gas reserves, which rarely adhere to the patchwork of surface ownership. Forcing holdout landowners into leasing agreements is supposed to lead to fewer wells drilled and more efficiency in the ones that are. But it’s also frequently used as a threat by landmen looking to cash in on leases.

Mortgages and Fracking

Recognizing the numerous ways that drilling and fracking could damage value, the mortgage industry is starting to refuse to take on the financial liabilities and is tightening policies that prohibit lending on properties with wells on them or that are subject to leasing.

- Following the debacle in North Carolina over severed mineral rights (see above) the State Employees’ Credit Union in North Carolina officially has decided it will no longer approve mortgage financing for properties where the drilling rights have been sold off to someone else. The credit union, which manages almost $12 billion in residential mortgages, said it considers loans on such land to be riskier than those where the mineral rights remain with the land.

- According to American Banker, at least three mortgage lending institutions—Tompkins Financial in Ithaca, NY, Spain’s Santander Bank and State Employees’ Credit Union in Raleigh, NC—are now refusing to make mortgages on land where oil or gas rights have been sold to an energy company. The publication quoted the president and CEO of the North Carolina credit union saying that if a landowner allows a drilling rig to go up on his or her their land, “We’d have to tell their neighbors, “We’re sorry, your property value just went down.’ ” (Also quoted in the Motley Fool.)

- Language in Freddie Mac’s standard mortgage contracts prohibit a “borrower from taking any action that could cause the deterioration, damage or decrease in value of the subject property,” and if the prohibition is broken by say, a landowner signing a drilling lease or entering into a mineral-rights agreement, Freddie Mac has the legal authority to exercise a call on a mortgage’s full amount if a borrower, according to an agency spokesman.

- According to a white paper prepared for the New York State Bar Association, Wells Fargo, one of the largest home mortgage lender in the U.S. is approaching home loans for properties that have gas drilling leases attached to them with a high degree of caution.

- In addition to Wells Fargo, Provident Funding, GMAC, FNCB, Fidelity and First Liberty, First Place Bank, Solvay Bank, Tompkins Trust Co., CFCU Community Credit Union are either putting hard-to-meet conditions on mortgages or denying loans altogether on properties with oil and gas leases. (Excellent summary of oil and gas issues related to mortgage lending from a brokerage vice president is available online.)

- The backgrounder prepared by the NYSBA about gas leasing impacts on homeowners also includes a section on residential mortgages and says the combination of home-ownership and drilling, “creates a perfect storm begging for immediate attention.” Risks include:

– Homeowners being confronted with uninsurable property damage for activities they cannot control.

– Banks refusing to provide mortgage loans on homes with gas leases because they don’t meet secondary mortgage market guidelines.

– Impediments to new construction starts, long a bellwether of economic recovery, since construction loans depend on risk-free property and a purchaser.

– The possibility of a property owner defaulting on a mortgage by signing a gas lease.

– Prohibitively expensive appraisals and title searches that are complicated by assessing the value of risks and the arcane paper trail of mineral rights and attached liabilities.

- A Pennsylvania couple was recently denied a new mortgage on their farm by Quicken Loans because of a drilling site across the street. According to the lender, “gas wells and other structures in nearby lots…can significantly degrade a property’s value” and do not meet underwriting guidelines. Two other lenders also denied the family mortgages.

- Federal lending and mortgage institutions (FHA, Fannie Mae, Freddie Mac) all have prohibitions against lending on properties where drilling is taking place or where hazardous materials are stored. A drilling lease on a property financed through one of these agencies would result in a ”technical default.” FHA’s guidelines also don’t allow it to finance mortgages where homes are within 300 feet of an active or planned drilling site. Also see http://bit.ly/1dIen28.

Insurance Coverage

Homeowners who think damage to property incurred by drilling accidents is covered by insurance need to think again. Such damages are typically not covered.

- Last July, Nationwide Insurance spelled out specifically that it would not provide coverage for damage related to fracking. According to an internal memo outlining the company’s policy, “After months of research and discussion, we have determined that the exposures presented by hydraulic fracturing are too great to ignore. Risks involved with hydraulic fracturing are now prohibited for General Liability, Commercial Auto, Motor Truck Cargo, Auto Physical Damage and Public Auto (insurance) coverage.”

- Often, a driller or well operator’s insurance won’t cover damages, according to the NYSBA summary. Homeowners may have to sue for damages and, even if they win, may not get paid for all damages since drillers admit in their regulatory filings that they may not carry enough insurance.

Other online resources:

- The New York Times has compiled hundreds of pages of documents related to drilling and property rights and values that include federal guidelines, emails from realtors and mortgage brokers, memos from bankers etc.

- Reuters investigated the mushrooming issue of split estates and the conflicts between mineral rights and property rights, finding numerous instances across the country of homebuilders and developers holding on to ownership of oil and gas deposits while selling off subdivision lots, while providing little to no information about the issue to buyers.